Important Japanese tax filing dates

In the last blog update, we talked about the three main taxes that all founders in Japan should be aware of. This time, we will talk about the the tax payment schedule and the timing involved. Many times, the tax deadlines sneak up on new, unsuspecting founders and they find themselves losing a large amount of cash suddenly.

For those that have not read the previous blog post yet, we high encourage readers to go back and review the details on the three main taxes before proceeding.

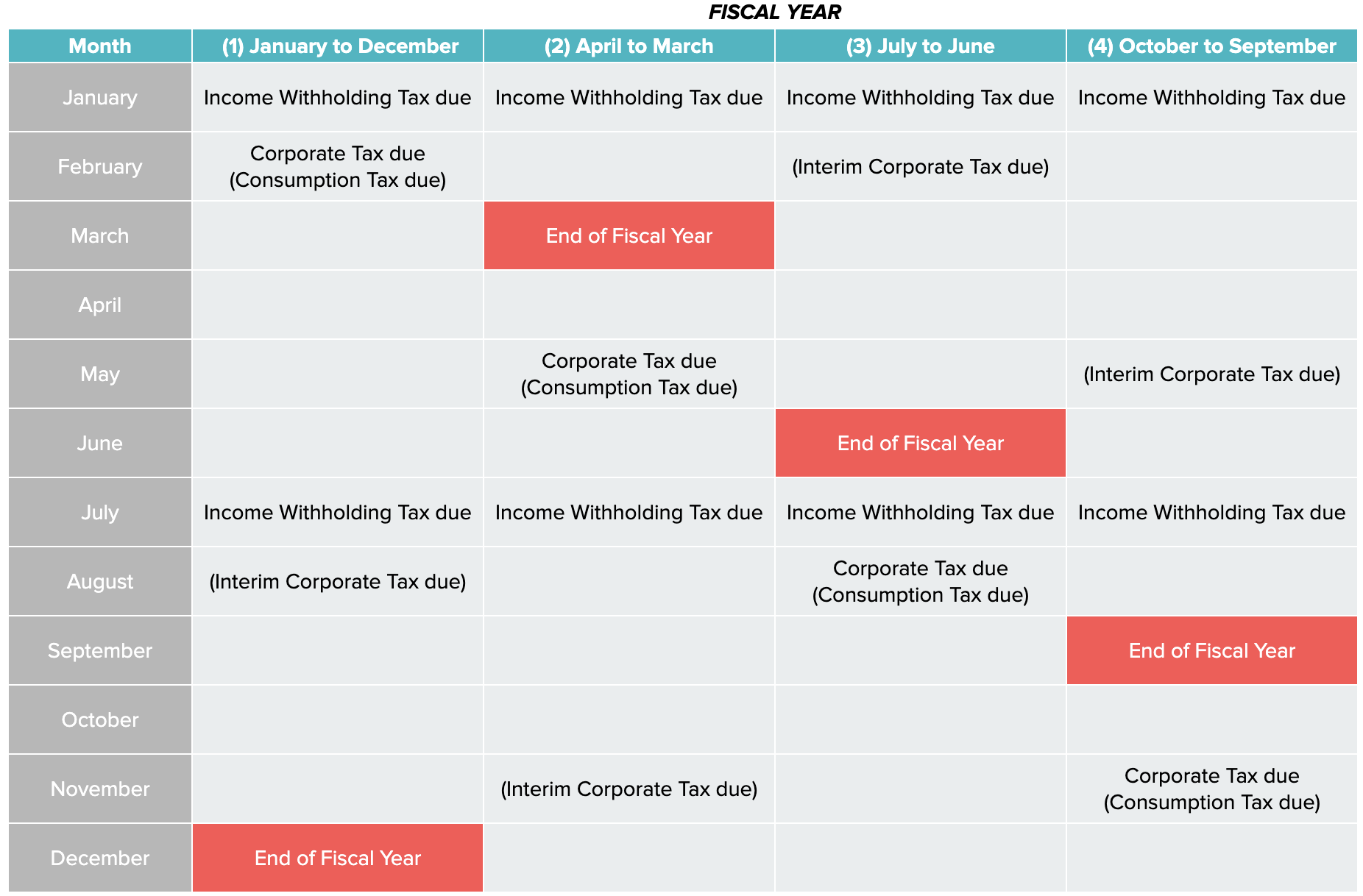

The tax payment schedule for the three main taxes follow a combination of the fiscal year and calendar year.

Fiscal year refers to the startup or company’s chosen tax period. This is determined during company establishment, and can be set to start and end in any month of the year. The fiscal year can also be changed.

Calendar year refers to the standard one-year period that starts with January and ends with December.

Tax payment due dates based on four example fiscal years: (1) January to December, (2) April to March, (3) July to June, and (4) October to September.

Corporate Income Tax

The Corporate Income Tax return and payment are due 2 months after the last day of the fiscal year.

Examples of fiscal years:

ending December 31 — due February 28

ending March 31 — due May 31

ending June 30 — due August 31

ending September 30 — due November 30

Interim Corporate Income Tax

Depending on each company’s tax situation and the previous year’s tax paid, there may be an Interim Corporate Income Tax return and payment required at the 6-month mark in the fiscal year. The company will receive an interim tax payment notice slip from the tax office if this is the case. Similar to the Corporate Income Tax above, payment is due 2 months after the last day of the 6-month mark.

Income Withholding Tax

Income Withholding Tax payment is based on calendar year instead of fiscal year, and will vary based on the whether or not the company has submitted and applied for the Application for Approval Made in Relation to the Special Provision for Due Dates for Withheld Income Tax.

If not submitted or not granted, then Income Withholding Tax will need to be paid by the 10th of the following month, every month.

If applied and granted, the payment will happen only twice a year:

July 10th, for income tax withheld for the first 6 months of the calendar year

January 10th, for income tax withheld for the last 6 months of the calendar year

A Withhold Tax Report will also need to be filed by January 31.

Consumption Tax

The Consumption Tax return and payment are due 2 months after the last day of the fiscal year.

Depending on company situation, the company may receive consumption tax payment notice slips throughout the fiscal year. There may be as many as one payment notice slip per quarter, for a total of 4 payments throughout the entire fiscal year.

With that, we have covered the major taxes that all founders should know about, along with their anticipated payment schedules. Management of cash is a big deal for founders in the early stages, and making sure that potential tax liabilities are covered during cash planning can go a long way.